- 5 mins read time

- Published: 10th September 2024

Time for Ireland to address past and current tax haven-like behaviour

Today, the European Court of Justice ruled that Ireland illegally provided state aid to Apple through a tax deal which upholds the European Commission’s 2016 decision. As a result, Apple must now pay back €13 billion in unpaid taxes.

In 2016, the European Commission ruled that a tax arrangement between Apple and Ireland from 2003 to 2014 gave Apple an unfair advantage to unjustifiably reduce its tax bill. This arrangement allowed Apple to pay only 0.005 percent of its annual profit in taxes. As a result, the Commission ordered Apple to pay €13 billion in unpaid taxes to Ireland, plus interest. Apple and Ireland challenged the Commission in court, with the General Court (lowest court) initially overturning the Commission’s decision. The Commission appealed the decision and in November 2023, the Advocate General recommended setting aside the General Court’s judgement and suggested a new decision. Today the Court of Justice’s final judgment in the matter and confirms the European Commission’s 2016 decision: Ireland granted Apple unlawful aid which Ireland is required to recover unpaid taxes.

This ruling exposes Ireland’s tax haven-like love affair with multinationals. It delivers long-overdue justice after over a decade of Ireland standing by and allowing Apple to dodge taxes. Apple’s profits almost doubled in 2021 compared to 2019, making it one of the biggest corporate winners of the pandemic. In 2023, Apple’s value reached $3 trillion, making it the highest-valued company in the world. This figure is greater than France’s GDP.

In the recent report Inequality Inc., Oxfam shows how corporate windfall profit and monopolies contribute to the concentration of wealth and power into the hands of the richest.

While this ruling will force the tech giant to pay its debt, the root of the issue is far from solved. Facilitating tax dodging on the scale that Ireland continues to do is not a victimless crime. Ireland has economic indicators typical of tax havens. According to a 2024 report by the European Commission, Ireland has higher outbound royalty payments, such as payments on copyright works and franchises, than the rest of the EU combined. Oxfam Ireland has highlighted this for a number of years and pointed out that by the EU’s own tax haven blacklisting criteria Ireland would qualify as a tax haven.

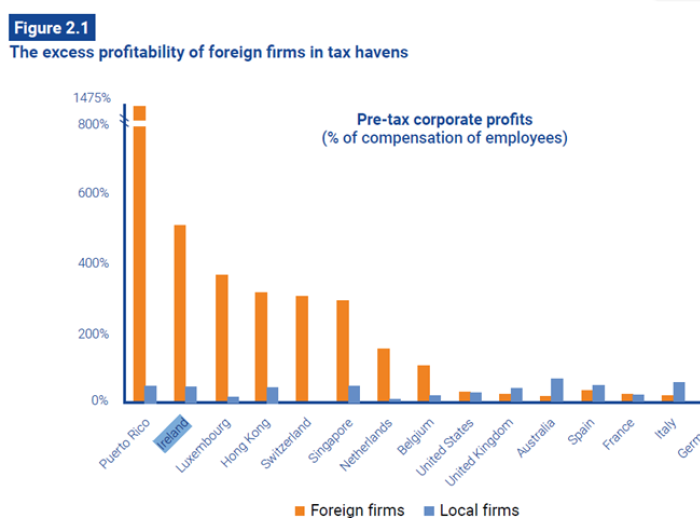

The level of tax avoidance facilitated by Ireland is highlighted in the 2024 EU tax observatory, using excess profitability of foreign firms (see graph below) and on the profit shifting. This report also details the many loopholes that still exist in Ireland to facilitate tax avoidance

Ireland is planning reforms to circumvent the OECD’s global minimum tax, changing the way companies can claim relief under certain credit programs that are not subject to the minimum tax. During negotiations at the OECD and EU level, Oxfam advocated to remove any exemptions.

Two UN bodies have stated that Ireland’s corporate tax policies may negativity impact the human rights of people in the majority world. They have recommended concrete measures that Ireland needs to take to fulfil its obligations under international human rights law.

In 2020 the UN Committee on the Rights of the Child agreed to examine the impact of Ireland’s international tax policy on the ability of countries of the Global South to raise revenue and fulfil their human rights obligations, in particular those that relate to children.

In March 2024 the UN’s most senior human rights watchdog, the UN’s Economic, Social and Cultural Rights Committee recommended that Ireland “strengthen measures to combat illicit flows, cross-border tax evasion, and tax fraud, in particular by wealthy individuals and business enterprises operating or domiciled in the state party’s jurisdiction”. Furthermore, it said Ireland must “take all necessary measures to avoid a situation which allows for shell companies to be used for profit-shifting, tax evasion and fraud by, inter alia, strengthening its legal framework and measures for the protection of whistleblowers”. It also called on Ireland to conduct an “independent and comprehensive assessment” of the impacts of its national and international tax policy on the economies of developing countries and to report on the findings.

Countries at the UN are currently negotiating UN tax convention, a process that has come about as most countries in the world have recognised that the OECD BEPS process has not achieved a fair global tax system. In August 2024 UN approved Terms of Reference (ToR) for the development of a UN Framework Convention on International Tax Cooperation (the Framework Convention). Ireland expressed its opposition to this process by voting against this proposal. A final vote will take place in the 79th session of UN General Assembly meeting, later in September 2024.

The European Commission has long asked Ireland to reform its laws on withholding taxes imposed on outbound payments (interest, dividends and royalty payments), to companies can no longer use loopholes in existing legislation. Outbound payments remain very important for the Irish economy. In particular, Ireland has higher outbound royalty payments than the rest of the EU combined.