Our Davos 2024 Report

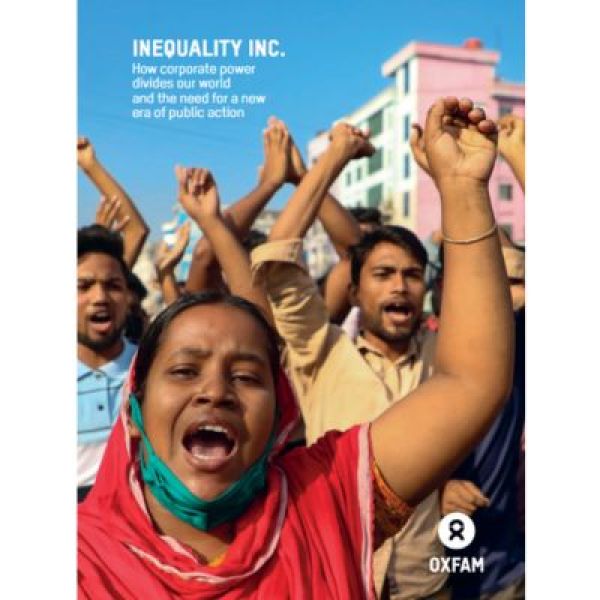

Oxfam's Inequality.inc Report

70%

Of the worlds biggest corporations have a billionaire CEO or a billionaire principle shareholder.

43%

The world's richest 1% own all of the global financial assets

1%

The richest 1% globally emit as much carbon pollution as the poorest two-thirds of humanity.

40%

Of the global seed market is own by two companies

Inequality Report

How corporate power divides our world and the need for a new era of public action.

It´s time for states to reassert themselves, including the Irish state. We are calling on the Irish government to properly tax wealth and close the loopholes for tax avoidance. Oxfam estimates that a progressive tax on wealth could yield up to €9 billion annually.— Bríd McGrath, Director of Public Affairs at Oxfam Ireland

Oxfam is calling on the Irish Government to:

- Introduce a permanent wealth tax on net incomes over US$5 million. A flat rate of 1.5% could yield $4.5 billion (€4.2 billion) or while a progressive rate on Irish multi-millionaires and billionaires at a rate of 2% on net wealth above US$5 million, 3% on net wealth over US$50 million, and 5 % on wealth above US$1 billion could generate US$10.1 billion dollars each year (€9.2 billion.)

- Close tax loopholes which could net €7.1 billion according to the Oireachtas Budget Oversight Committee 2022 report.

- Implement recommendations from the Commission on Taxation and Welfare which the Irish Fiscal Advisory Council estimated could yield €15 billion.

- Refuse taxpayers´ money to corporations who flout the law of the land or operate contrary to stated government policy